Refinance now to keep more in your pocket

✓ Apply and get a decision in minutes

✓ Discount your own rate as you pay down your loan

✓ Switch to the #1 digital home loan lender

Switch to a lender

who gives a buck about you

Check out our home loans with award-winning features that free you.

You’ve got nothing to lose except your mortgage!

Pay less for your loan

Great rates that stay great

Our award-winning loans have great rates and no fees on Straight Up and Power Up variable loans².

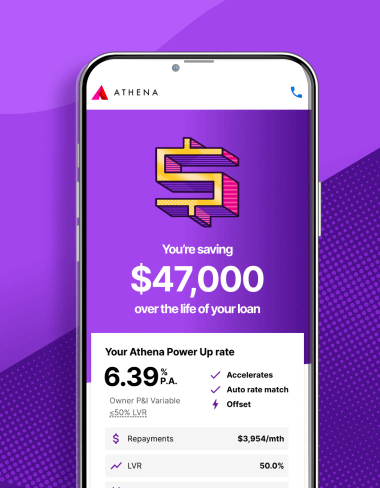

Discount your own rate

Your home loan rate is automatically discounted as you pay down your loan with our Aussie-first AcceleRATES†.

Save for your future

Join thousands of Aussies who could be saving an estimated average $60K over the life of their loans. See how we worked it out**.

More power to you

Make changes to your loan

Make changes to your Straight Up or Power Up loan fee-free as your financial goals or situation changes.

Flex your repayment options

Pay via direct debit, from your redraw or offset or via salary crediting. Choose a frequency that suits you – monthly, fortnightly or weekly.

Power Up your loan

Need more features like multi-offsets and split loans? Upgrade to Power Up loan anytime to supercharge your financial journey.

Unlock equity

Free up money

Access equity in your home quickly and put the extra $$$ towards renos or investments with a refinanced home loan.

Features for freedom

Our Power Up variable loan gives you offsets and splits to supercharge your home loan.

See your equity

Our equity calculator will show you how much usable equity you could access.

We'll treat you right

Loyalty is royalty

We put existing customers first. Our Automatic Rate Match gives existing customers the same rates as new customers on like-for-like loans¹.

Aussie-based support

Our Loan Experts are here to help you 5 days a week.

Manage your loan with the Athena App

Your home loan, literally in your hands. We’ve got all the basics covered plus more with our highly-rated app.

Our ultimate home loans 🏡 🏠 🏘

All our award-winning loans have super sharp rates and Aussie based home loan experts to help guide you through application and beyond.

Rates from 5.99%^

No frills or fuss, just an awesome low variable rate with redraw.

✅ No fees²

✅ Redraw

❌ Offset

❌ Multi-offset

❌ Split loans

✅ Aussie loan experts

Power Up ⚡

Rates from 6.14%^

Variable rate with offset & splits for extra flex & saving power.

✅ No fees²

✅ Redraw

✅ Offset

✅ Multi-offset

✅ Split loans

✅ Aussie loan experts

Rates from 6.24%

(6.10%^ comparison)

Lower your repayments and free up cash as a short term option.

✅ No fees²

✅ Redraw

✅ Offset

✅ Multi-offset

✅ Split loans

✅ Aussie loan experts

Straight Up and Power Up rates are variable & comparison^.

Refinancing with Athena is easy

Get a quote in under 5 minutes. No credit checks yet. We only ask for your property and current home loan details.

Meet our Loan Experts

Our friendly local home loan experts are here to answer all your questions, 5 days a week.

Talk to us about

→ Rolling off a fixed rate

→ Unlocking equity to achieve your goals like a reno or investment property purchase

→ Refinancing to consolidate debt

→ Lowering your repayments with an Interest Only rate

Learn more about choosing the right home loan

Principal & Interest vs Interest Only

It’s all about paying it off or putting it off. What is a Principal & Interest home loan?

Hacks to pay off your home loan faster

We'll help you pay down your home loan faster with our simple shortcuts.

Do you pay less interest if you pay weekly?

Shave thousands and years off your loan by understanding repayment calculations.

Our mortgage rates for refinancers

We have two variable home loan options for refinancing your property - Straight Up and Power Up.

If you're after stability for peace of mind, we also offer fixed interest rates.

Our Straight Up rates

| LVR Tier | Rate | Comparison Rate |

|---|---|---|

0-50% Obliterate | 5.99% | 5.99% |

50-60% Celebrate | 6.04% | 6.02% |

60-70% Evaporate | 6.09% | 6.06% |

70-80% Liberate | 6.14% | 6.10% |

Our Power Up mortgage rates

| LVR Tier | Rate | Comparison Rate |

|---|---|---|

0-50% Obliterate | 6.14% | 6.14% |

50-60% Celebrate | 6.19% | 6.17% |

60-70% Evaporate | 6.24% | 6.21% |

70-80% Liberate | 6.29% | 6.25% |

FAQs

What’s the process to switch over?

Am I eligible to refinance to Athena?

Which AcceleRATE tier will I be on?

I want to refinance multiple properties over to Athena

Can I refinance with equity release?

Can I refinance to consolidate debt?

How do valuations work at Athena?

How long does it take to switch over?

Will I be charge penalty fees by my current lender?

Our disclaimers

Please take a moment to read our disclaimers, thanks!

Athena's disclaimers