Back

What interest rate rises will mean for you

8 min read | 24 Aug 2022

The RBA has raised its interest rates multiple times this year, and it looks like there’s more to come. Their aim is to combat inflation. Higher rates means it costs more to borrow money, tightening the squeeze we’re already feeling. The dial on interest rates seems like it’s continuing to trend upwards, probably not to double digits, but experts think it’s likely to go up a few more percent by the end of the year. So, what does that mean for you and your mortgage? It doesn’t mean it’s a bad time to own property. What it does mean is that you should arm yourself with knowledge about the new terrain. Understand why interest rates work the way it does and make sure your circumstances and your mortgage remain on good terms in spite of further changes coming ahead.

Reasons why interest rates rise

There are 2 main influencers in Oz that can make interest rates go up, down and around:

1. Inflation and the cost of living

Food, petrol and the price of materials are all on the up for a number of reasons at the moment - think COVID disruptions and the war sending energy prices soaring. Inflation is one of the measures of price increases for households on average (by comparing a basket of goods).

Fast-rising inflation isn’t good because it means that the ‘cost of living’ for people to live the same way they’re used to becomes more expensive than it was before.

When inflation and the cost of living go up, usually speaking the RBA will use interest rates as a way to reduce consumer spending which in turn usually reduces inflation. Inflation is when the cost of things is more than what it used to be. This is caused when it is more expensive to sell a product or service OR too many people wanting to buy the same things which means it pushes prices up - like property prices! Reducing demand should reduce the cost. This is supply and demand economics.

2. The RBA cash rate

To keep the economy humming along in a good state, the Reserve Bank of Australia (RBA) aims to keep the costs of goods and services at a level people can afford, with inflation ideally at around 2-3%. One way it does that is by setting the “official cash rate”, which is like the wholesale interest rate banks pay to borrow money. The RBA raises or lowers the official cash rate according to what’s happening in the economy and how they want the economy to respond. For example: When inflation is running high, the RBA will want to drive it down by getting people to spend less. How will they do it? By increasing the official cash rate, which usually causes lenders to increase their interest rates, making it more expensive for people to borrow money, which means higher loan and interest repayments. This is to encourage people to reduce spending due to higher mortgage repayments. Less spending means less demand for goods and services which should in theory reduce the increase in prices to ease inflation. When inflation is low (as it had been for the past few years), the RBA may try to stimulate spending in the economy. How? By lowering the official cash rate. Lenders will usually follow suit to lower their interest rates to customers so their repayments become lower. When repayments are lower, there’s more demand for housing which in turn creates jobs that fuel the economy. Lower repayments also mean more disposable income and more money to spend which helps drive growth in the economy.

Rate rises and the impacts on your finances

In line with the Reserve Bank’s increases of the official cash rate, lenders have started lifting their mortgage interest rates. What could this mean for you? Here are 4 things to look out for:

1. Your home loan repayments could change

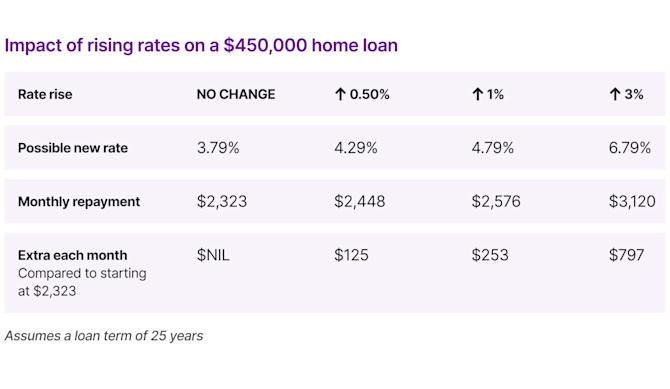

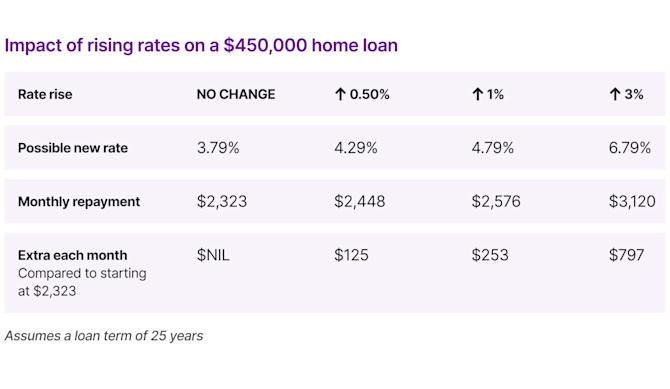

If you have a variable rate mortgage, your interest rate would have increased recently in line with official cash rate increases. That means your repayments would have gone up too. But if you’re on a fixed rate home loan, nothing will change until your fixed term ends. To get a feel for what may lie ahead, take a look at the numbers below. Our number crunching shows how a rate hike of 0.50% on Athena's cuAug rrent lowest rate (August 2022) of 3.79% (to 4.29%) would increase monthly repayments by $125 on a $450,000 home loan over 25 years.

Now we all know that rates could go higher over time, making it important to think long term because that’s where you can make a difference now. It’s unlikely that rates will rise by 3% for a while yet (if at all), but looking at your numbers now means you can tweak your budget ahead of time so you’re better prepared to go with the flow.

2. Repayments on other loans are rising

It’s not just mortgages that get affected by the RBA's rising cash rate. Personal loans, car loans, credit cards… the interest rates on all kinds of debt are gradually going up too, which means your repayments will take up a bigger chunk of your budget. So if you can, probably a good idea to clear any of those debts sooner rather than later.

3. Better returns from your savings

It’s not all a drag when the RBA raises the cash rate. Because when interest rates on loans go up, interest rates on savings and term-deposit investment accounts go up too - great news considering they’ve been returning next to nothing in interest in most recent times. That makes now the right time to have a look around and see how the interest rates on your current savings account and term deposits compare with the other, more secure investment options out there so you can find the best deal.

Top tip! If you’ve got a home loan with a redraw or offset, you’d be better off putting money into it so long as your home loan rate is higher than your savings account. Every deposit immediately reduces your loan balance for interest charges. Read more here.

4. Cooling off on property prices

Higher interest rates means that some borrowers won’t be able to afford to buy right now and for those still in the game, some won’t be able to borrow as much as they previously could. Fewer people in the market and lower borrowing power could help cool the skyrocketing property prices a bit. So, if you’ve been saving up for your dream home and your budget allows for it, even with higher interest rates, it might be a great time to look around and hope your budget stretches further than it did before rates started going up.

Take the pressure off yourself by switching your home loan

If you’ve already got a mortgage but the rate rises have you feelin’ nervous, here are a few steps you can take to make yourself a little more comfortable. If you're an Athena customer, you should also take a look at our 5 ways you can be better off as rates rise article.

1. Switch to Interest Only

If refinancing from Principal & Interest to Interest Only would take some of the pressure off, it’s generally pretty straight forward. Just know that you won't be paying down the principal when you're on an Interest Only loan.

Learn more about Principal & Interest vs Interest Only loans.

2. Switch to a Fixed Rate loan or a split loan

You know what happens if your costs don’t change? You don’t need to keep going back into Excel to adjust your budget spreadsheet. Like the sound of that? Then switch to a fixed rate home loan. With a fixed rate home loan, a specific interest rate for a specific length of time (usually 1-3 years) is locked in, so your loan repayments stay exactly the same. And if variable rates go up, it won’t affect anything for you during your fixed-rate period. Phew! If only it was possible to fix the price of lettuce. OK, great, but what’s the downside? Well, there is a price for all that set & forget peace of mind. Your interest rate will generally be higher than the current variable rate. Why? Because lenders predict that market rates in the future are more likely to rise than fall, and the higher interest rate now is supposed to cover the risk the lender is taking in case rates don’t rise as much as they’ve predicted. So your choice is, pay the lowest rate now and trust that things won’t change very much, or pay a bit more now to insulate yourself from increases down the track that may or may not happen. While there isn’t a clear-cut answer of what’s 100% best, you should consider weighing up the pros and cons of each according to your own circumstances and projected budget. Here are some of Athena’s fixed rate features:

The flexibility to make additional repayments of up to 5% of loan balance

Lower interest rates for lower LVRs

No application fees, ongoing fees or exit fees

Oh, and there’s also a third option: giving part of your loan a variable rate, and the other part a fixed rate. That’s called a split loan. At Athena, we don’t do split loans just yet but it’s coming soon!

To learn more about fixed rate vs variable rate loans, click here.

3. Switch lenders - refinance to Athena ;)

Maybe you’re unimpressed with your current loan’s interest rate? They’re offering new customers a lower rate than existing loyal customers? You’d like some different features, like a fee-free offset account? Or you’ve fallen out of like with your current lender?

There are a lot of good reasons people decide they feel like their current lender is no longer the right one for them. Maybe they were once, but not any more.

Repaying a home loan affects so many other things in your life, so it’s really important to feel a strong sense of control, ownership and satisfaction towards it. Because if you don’t, you could really come to resent it. Parting ways and changing to a different loan and lender that are more compatible with you may seem like too much of a hassle, but it’s actually easy to do and usually well worth it. So if you’re feeling trapped by your current home loan, or you’re no longer happy with your lender, making a fresh start by refinancing is well worth thinking about.

See how much you could save with Athena

We estimate our customers will save an average of $61,000 over the life of their loan**. In addition to our low rates, we offer zero fees, the same low rates whether you’re new or already with us with our Automatic Rate Match, and with Athena AcceleRATES, the more you pay down your loan, the more we’ll lower your rate - automatically. So start saving a whole lotta time and money. You’ve got nothing to lose except your home loan!

You’ve got nothing to lose except your home loan!

Start saving a whole lotta time and money

** The interest savings estimate is an average of modelled savings of real customers who have refinanced to Athena since launch. The savings are modelled estimates only, and are not a prediction. The actual future savings of these customers may be higher or lower. The estimated savings depend on assumptions that may change over the life of the loan, such as future interest rates and future borrower repayment behaviour.

In making the average savings estimate, we assume the rates of the existing lender and Athena continue for the life of the loan, and we do not include the fees which may be charged by the existing lender. The remaining term and repayment frequencies are assumed to be the same as the Athena loan, and all repayments are assumed to be made on time with no redraws or credit limit increases. Every borrower’s situation is different. Your actual savings opportunity may differ from this average.