Back

Negative gearing and positive gearing: the pros and cons

7 min read | 23 Jun 2020 - Updated 4 May 2023

Negative and positive gearing for investment strategy

Pros and cons of negative gearing negative and positive gearing are two different property investment strategies that property investors may deploy depending on their situation and long-term financial goals.

The overall difference between the two is an income outcome. With negative gearing, you have to top up your investment costs, as opposed to positive gearing where the costs of the investment are covered by the income it yields.

Sounds simple right? Well it is, kind of - but there are other benefits and implications for property investors that you should know about!

What is negative gearing?

Negative gearing is when the income derived from the property is less than the expenses incurred running the investment. That can include the cost of your investor home loan, council rates and charges, insurance, real estate agent fees, and certain maintenance and upkeep costs.

Investors can claim this net loss against their total taxable income at tax time. This reduces the taxable income by the amount of the loss and therefore reduces the tax payable, making it an attractive strategy for some.

Property expenses

Council and water rates

Land tax Repairs

Insurance premiums

Real estate agent / property management fees

Maintenance costs

Other costs associated with the investment such as the property price

Borrowing costs

Interest payments

Establishment

Other fees charged by your lender

Depreciation

A tax deduction for investors to claim the decline in value over time of the rental property building structure and, for new dwellings, the fittings within the property.

Some investors prefer new builds because of this but they need to weigh this up against other risks associated with this type of investment.

The depreciation of the building structure is generally claimed over 40 years from the completion of build, meaning newer buildings typically have more left to write off.

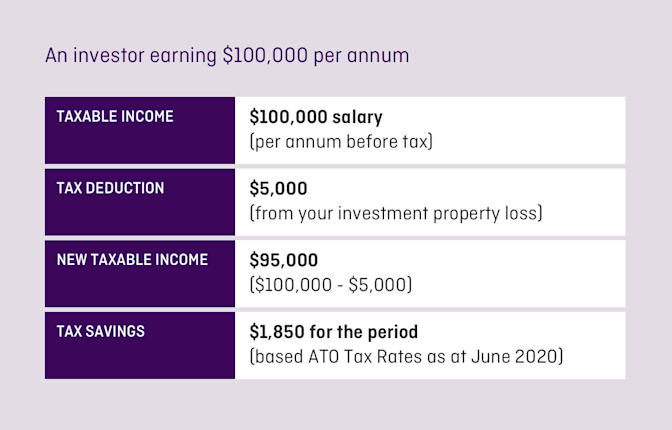

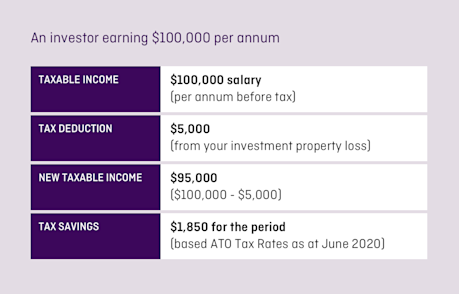

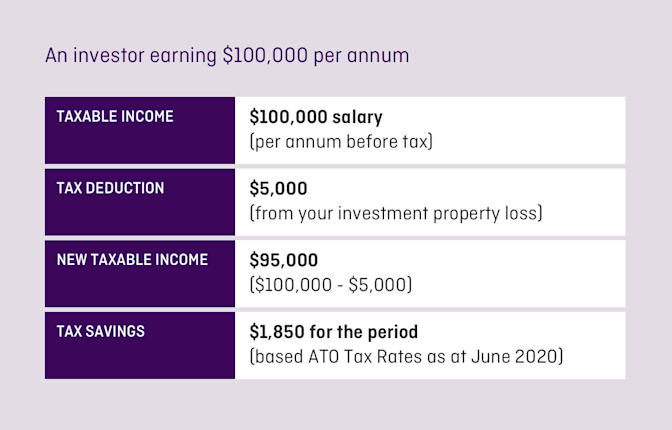

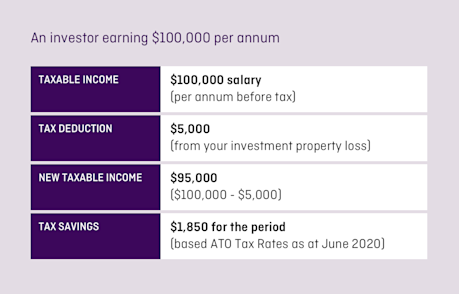

Here's a simple example of a negatively geared property that was bought for $450,000

This property has a rental income of $20,800, but the outgoings exceed the income it generates.

The interest payments ($10,8000) and property costs ($15,000) equal $25,800. So there's a net loss of $5,000.

This loss could be deducted from the investor's total income, which means they will be taxed on a lower amount.

For example:

Let's say an investor earns $100,000 per annum.

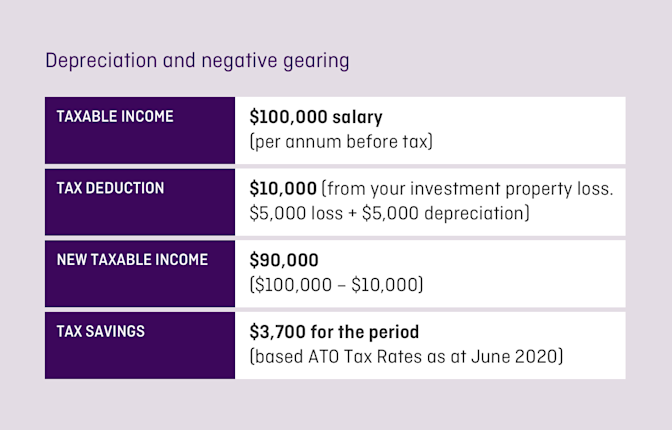

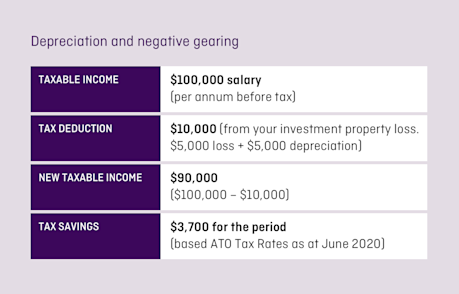

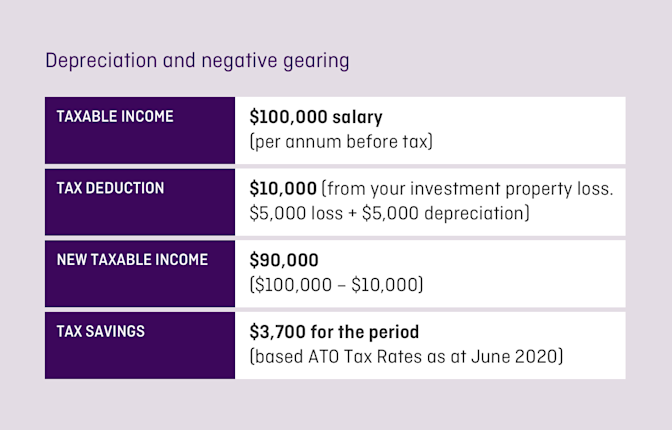

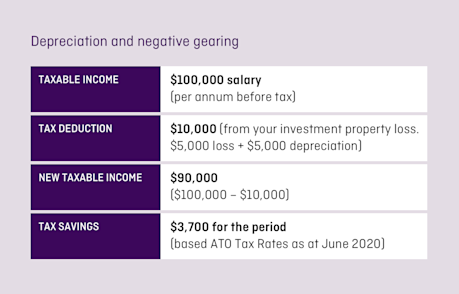

Depreciation and negative gearing go hand-in-hand

Including depreciation within negative gearing expenses can increase the loss on paper, without incurring a cash loss. Depreciation takes into account the general wear and tear of an investment property which can increase the investment expenses and increase the amount of tax deductions.

In Australia, investors can claim tax deductions on both the decline in value of the buildings structure and for new builds, items considered permanently fixed to the property plus equipment assets found within (such as ovens, dishwashers, carpets, blinds etc).

Take the example above and add in an extra depreciation cost of $5,000. This can be added to the net loss on the property.

Negative gearing strategy

Some property investors own their own home, plus one or two investment properties.

These investors may wish to ensure that they get the most out of their properties and set up their home loans in a way that maximises their tax-deductible interest, and therefore reduces the tax they pay at the end of each financial year.

Some investors do this by:

Interest only home loan

Taking out an interest only loan on the investment properties.

By keeping the principal high on their investment loan, the interest charged is higher. These investors may divert their remaining cash into paying down an owner occupier property instead because the interest paid on the home loan is normally not tax deductible.

If the investment properties are positively geared producing excess cash, use that additional cash to help pay down the principal on the owner occupier home loan rather than the investment loan. This keeps the investment principal higher, to increase interest costs on the asset that can be treated as tax deductible.

Redraw or offset account

Using a redraw or offset facility on the home loan to support cash flow into the owner occupier property, and provide flexibility to take it out when needed either for the investment property, a future property or any other life event.

Setting up borrowing structures to allocate as much debt across the portfolio into investment loans. This might mean borrowing more on an investment property relative to the borrowings on a home.

These strategies increase the debt and therefore interest paid on investment properties, which increase the available tax deductions.

What role do interest rates play in negative gearing?

When interest rates are low, investors should consider whether they could still afford repayments if their interest costs were to rise.

At the end of the day, paying a higher rate on your investor mortgage unnecessarily is like throwing money away. The higher the interest rate, the more interest is to be paid to the lender.

And why do that when you could use the money to add capital value to the property, which could increase sale value or rental yield, or alternatively investing the saving elsewhere.

The goal is profit

It's important property investors have a good understanding of what the potential costs are if they plan to negative gear and consider if they can afford those costs.

Negative gearing allows investors to recoup some of the costs in tax savings, but it still results in losing money. Investors need cash to fund the negative gearing and the tax refunds may be delayed for a year or more.

If an investor is confident their property will deliver capital growth in the long run, they may be comfortable with temporary losses. The hope is that these losses will be compensated in the form of capital gains in the future when the property is sold down the track for a nice big profit.

Are there any risks associated with negative gearing?

Negative gearing isn't risk free and so you should always obtain specific advice on your circumstances. It can help you reduce your tax bill, but there's still the chance that you might lose money, especially in tough property market conditions.

Similar to what happened as a result of COVID-19, the rental market might tip towards the tenant's favour. If this happens, the rental income might drop or, even worse, an investor might find their property vacant for some time.

A savings buffer to cushion against any shocks to cashflow is important.

A sudden job loss or expensive emergency repairs can squeeze cashflow and impact investors ability to pay the loan.

Another thing to keep in mind is needing to sell when housing prices are falling, or if the property doesn't grow in value as much as expected, you might not be able to recoup your investment losses incurred from negative gearing.

That's why it's incredibly important for property investors to research the suburbs they buy in to understand the potential for long-term ability for capital growth so they eventually make money from their investment.

Investors seeking long-term rental income

These investors may need to negatively gear while they chip away at paying down their mortgage before it flips to being positively geared, or they own the property outright.

In the meantime, the tax benefits from negative gearing may help cushion the losses somewhat.

Investors seeking long-term capital gains

To play the long game, they'll need to limit losses by recouping as much of it as they can through negative gearing, until the time is right for them to sell with hopefully a sizeable capital gain which offsets the residual losses carried each year.

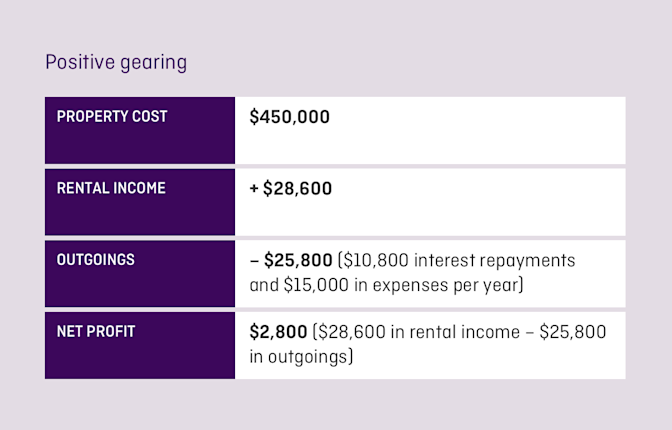

What is positive gearing?

Positive gearing is when earnings are higher than the amount spent on the investment, so there is a profit.

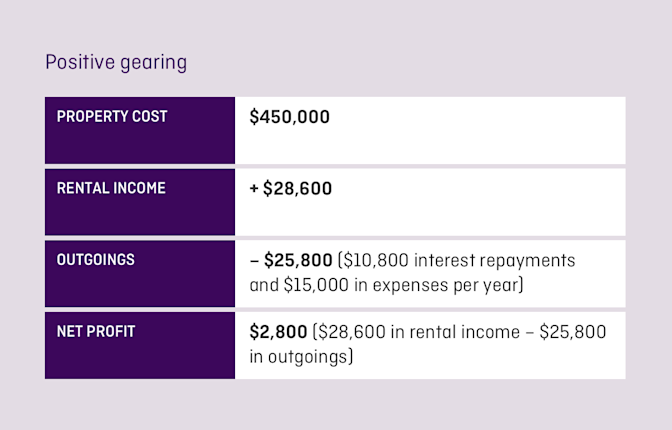

Check out this example:

Positive gearing is generally seen as lower risk than negative gearing, as it provides more predictable returns and consistent income.

The surplus income may cushion investors from any interest rate hikes, increased home loan repayments and unexpected property (or life) costs.

At the outset, depending on market conditions, rental return and size of the loan, an investment property may not be positively geared. Factors like the loan being paid down faster, interest rates falling or rental yield increasing can create the conditions for the investment to become positively geared.

With a positively geared investment, investors are not able to reduce their income or get tax benefits. But positive gearing provides additional income which can be used to pay the loan down faster, or invest elsewhere. ‘Profit' made on the rental income will be taxed at the marginal tax rate.

Some pros and cons of negative and positive gearing

Both negative and positive gearing has pros and cons which investors need to consider.

Ultimately, the strategy that's best will depend on individual goals and financial circumstances.

How are negatively geared properties assessed by Athena?

Athena takes negative gearing into account when we assess your ability to repay the loan. However, some lenders do not. For this reason, and others, some property investors choose to spread their lending across multiple lenders to meet their needs.

Whilst this has been hopefully an enjoyable and informative read, don't forget to get your own financial and tax advice!

Athena is an award winning home loan provider. Our investor home loans have been recognised by Australia's leading comparison websites for their low rates, innovative offering and flexible payment terms.

Want to chat to us about your options before you apply for a home loan?

Arrange a callback with our Aussie loan experts.

The information in this article is of a general nature only, and does not constitute advice. You should obtain specific advice on your circumstances.

You’ve got nothing to lose except your home loan!

Start saving a whole lotta time and money