Back

How often should you refinance your home loan?

4 min read | 6 Jan 2020

Your home loan shouldn’t be a set and forget.

We’ll make this simple. There are zero rules about how frequently you should refinance your home loan – it’s 100% your call, and comes down to whether the time is right for you. What *right* and *time* looks like can feel murky, but you should be aware of what’s out there on the market. Set and forget is what the banks want you to do, because before you know it you’re paying them thousands of dollars in fees you had no idea you were. You should be doing regular ‘health checks’ on your home loan to see if you’re getting the best deal.

Why would you refinance your home loan?

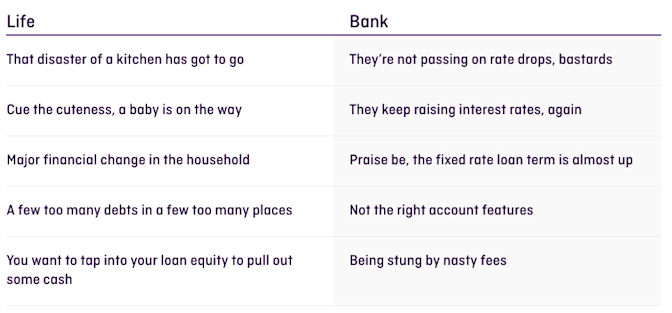

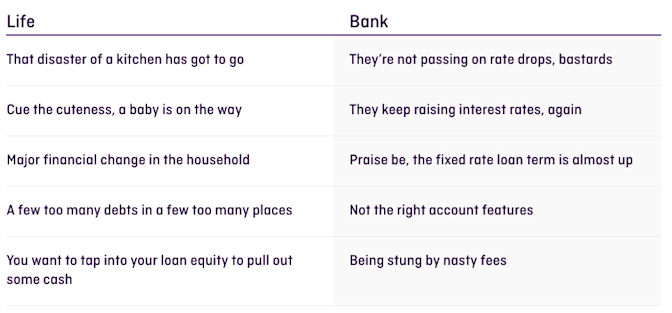

Hardly exhaustive, but the general reasons for why people switch banks and refinance their home loans falls into two big categories – life and banks. It’s these things that can influence when and how often you should refinance.

Refinance for feature fit

What’s ‘ultimate’ for you may be ‘no thanks’ for someone else. Either way, account features are a major factor in the timing of a refinancing decision and can make a big difference in terms of paying down your home loan faster.

Loan term - say you want to shave time and money off your loan by shortening your loan term and your lender won’t come to the party (or they will, but they’ll charge you for it). Time to switch to a lender that lets you refi without the restart – i.e. someone who doesn’t dictate your terms by defaulting you back to the original 30-year sentence. (Aim for the number of years you have left, or less!)

Ahhhh, fees – it’s easy to settle into a loan, easier still to be stung unnecessarily without realising it. These fees can quickly add up and could cost you thousands over the life of an average market loan. Find a lender like Athena who charges zero fees.

Blatant inflexibility – from making repayments when you want so you can pay less interest (e.g. weekly rather than monthly) to accessing extra repayments, it’s no fun feeling boxed in. Frustrating too when it stops you from saving money.

Is it worth it to refinance?

Hell yeah if it’s with Athena. Always check that the savings in repayments and fees outweigh the cost of refinancing (typically government fees and a discharge fee with most lenders). Most lenders have a calculator that will show you how much you could save if you switch. Try our savings calculator to see how your current loan stacks up against an Athena home loan. You’ll be blown away with how much you could save.

Signs that you should consider refinancing

Your fixed loan period is ending – if you stick with your current lender rather than go elsewhere at the end of your loan term, you could be hit with a higher variable rate...sneaky. Set a reminder 3 months before the end date so you can start looking around. Don’t snooze that alarm, you could be saving yourself a whole lotta time and money.

Your rates are going up outside of RBA changes – if you have a variable or split rate loan, open your emails and snail mail, and read your statements! Make sure you understand exactly what they’re telling you, and if they’re making not-so-great changes behind your back to your rates, don’t settle for it.

Your current lender wants you to pay fees – if your bank is charging you fees such as monthly account fees, package fees, redraw fees, early payment fees, fees to switch to another lender or fees to sneeze, then you need to leave! Check your statements to see if this is happening, sometimes you’ll have no idea. We charge zero fees. ;)

Stay on top of your numbers

Make an annual calendar reminder to check your home loan and how it compares. Be sure you aren’t getting penalised with rate hikes and extra fees for being a loyal customer.

Refinancing to Athena - it adds up

You’re here because you’re interested in getting a better deal, good on you. Use our savings calculator to see how much you could be saving in $$$ and years off the life of your current home loan. We’re saving our customers on average $60,000 (and often way more) off the life of their loan.*

Athena actively helps you pay down your loan faster - our home loan experts will hold you accountable for that and send you regular helpful nudges.

You’ve got nothing to lose except your home loan!

Start saving a whole lotta time and money

*Average interest savings estimated across all Athena customers who refinanced to Athena’s variable rate. We calculate the savings by comparing rates, any amount in redraw and offset between both loans and any fixed rate break fees (only where disclosed). All calculations assume the interest rate applies, and all repayments are made on time with no withdrawal of extra funds, for the life of the loan. We assume there are no ongoing fees charged on either loan, and both loans have identical terms remaining and repayment frequencies unless otherwise stated. Actual savings may differ from estimates. Information correct as at September, 2019.