Back

Athena passes on the RBA rate cut in full immediately

4 min read | 3 Mar 2020

For the fourth time in a row Athena has immediately passed on the RBA rate cut in full to new and existing customers.

The RBA has announced a rate cut of 0.25% (25 basis points). Athena is proudly the only lender to immediately pass on the full rate cut savings for the last 4 announcements.

“This is money that belongs in the pockets of Aussie families”

None of the 12 largest lenders have done this. We believe this is money that belongs in the pockets of Aussie families.

The potential savings are huge

The 4 RBA rate cuts since June 2019 have now cut the cash rate by a full 1.00%. A family with a typical home loan could save as much as $80,000 over the life of their loan. If they kept their mortgage repayments unchanged as rates fell, the savings could rise to $120,000 and cut 5 years off their mortgage.

Sadly, not one of the 12 largest home lenders passed on last year’s 3 RBA rate cuts in full. The cost to Aussie families is staggering. By delaying the savings by 2 weeks on average, these lenders cost borrowers over $350M. Failing to pass through the full interest savings costs over $2 billion in annual excess interest costs. It’s a major headwind to the RBA’s efforts to drive sustainable growth and full employment in Australia.

Aussies know they are getting a raw deal

A recent Athena survey showed only 18% of respondents were confident their lender had passed on the recent rate cuts in full. 64% of respondents who did not receive the full cuts are now considering a switch to a lender that passed on the rate cuts in full. 72% think they can get a better deal on their loan elsewhere.

“Put your bank to the test. If they don’t drop your rate, then drop your bank”

Our message to Australians is this: Put your bank to the test. If they don’t drop your rate in full, then drop your bank. The savings opportunity is too important to be short-changed.

Customers who have been with Athena since the June rate cut have now received the entire 1% off their rate.

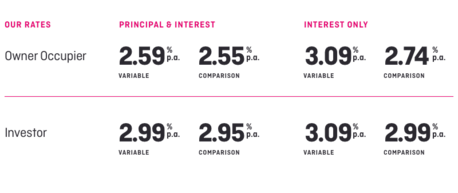

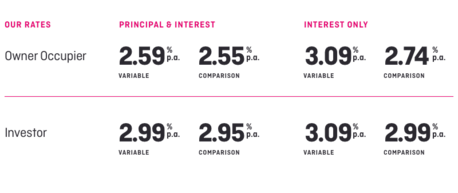

Our owner occupiers on principal and interest now have a variable rate of 2.59% and a comparison rate of 2.55%. We are determined to help our customers pay off their home loans faster and save a whole lot of money in the process.

Property investors are also winners with a comparison rate that now starts with a 2.

No rate cut = vote with your feet

Treasurer Josh Frydenberg urged customers to shop around and vote with their feet, after the major lenders refused to pass on the last interest rate cuts in full. He highlighted Athena’s variable rate as being better than the major players, as well as its decision to immediately pass on the rate cuts in full.

Australians should expect their lender to give them what is theirs to have. Too often lenders hold onto the RBA rate cuts or they give them to new customers while loyal customers miss out.

This is one reason why less than one in five Australians trust that their lender always acts in their best interests. So Athena’s message to Australians is not to wait for their lender to start operating with fairness. Instead to change to one that will.

We challenge the industry to do as we have done and immediately pass on the rate cut so customers – new and existing – so they can experience the full benefits of the cut.

Athenamazing stats from Athena homeowners

Almost $150 million saved over the life of their loan

On average are knocking three years off their loan

Over $60,000 saved over the life of an average loan by switching to Athena from typical big bank rates

Pay off your home loan faster

Athena is one of Australia’s fastest growing fintechs. We find efficiencies in technology and pass on the savings to customers. Demand for our home loans is driven by our promise to never charge an ongoing application, account, or exit fees; and to always reward loyalty instead of inflicting a loyalty tax.

Athena offers all customers a loyalty bonus discount of 0.01% off their home loan rate each year for the first five years. The discount is applied for the life of the loan. Home loans should not be a life sentence and can be paid off quicker.

Note: Findings on Australians’ relationship with lenders are from research conducted by CoreData for Athena Home Loans: surveying 1,000 respondents aged 21-60 years old in October 2019.The sample is representative of the population of Australian home and investment loan customers in terms of age group, gender and wealth segment.

You’ve got nothing to lose except your home loan!

Start saving a whole lotta time and money