All applications are subject to eligibility and assessment. Government charges may apply.

ᶺ Comparison rate calculated on a $150,000 secured loan over a 25 year term. WARNING: Comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Comparison rates for Fixed rate loans are based on a Straight Up revert rate. Comparison rates for variable interest only loans are based on an initial 5-year interest only period. Comparison rates for fixed Interest Only loans are based on an initial interest only period equal in length to the fixed period. During an Interest Only period, your Interest Only payments will not reduce your loan balance. This may mean you pay more interest over the life of the loan.

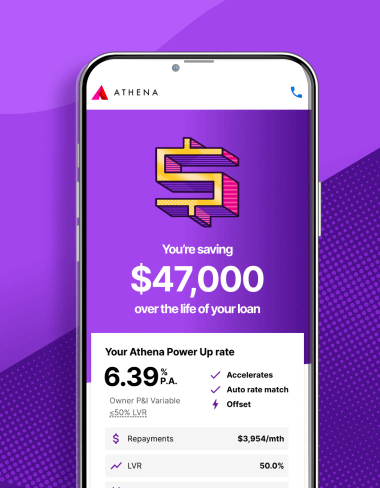

** The interest savings estimate is based on average savings of actual customers who have refinanced to Athena's Classic, Straight Up, and Power Up products since launch. It is a modelled estimate and does not predict actual future savings. Assumptions like interest rates and borrower behaviour may change over the loan's life, impacting the estimated savings. Fluctuations in interest rates are not considered. The current interest rate environment may differ from historical trends, affecting actual savings. Fees from the existing lender are not included. The estimate assumes the same loan terms and timely repayments. Individual situations vary, so seek professional advice before making financial decisions.

¹ We don’t charge any Athena fees on Straight Up or Power Up home loans. However, government charges or third-party costs may apply. Break costs may also apply if you make changes to a Fixed loan. Athena fees apply to Tailored home loans.

² Athena Straight Up and Power Up interest rates comprise of a reference rate for each product purpose and repayment type less an LVR (loan to value) based discount. Athena Tailored interest rates are compromised of the final applicable rate only. You can find our current rates, reference rates and LVR discounts here. Interest rates may change at any time. Athena’s Straight Up and Power Up Home Loan products are able to access the AcceleRATES discount. The interest rate these products have applied is calculated by applying an LVR percentage discount onto the reference rate. If the LVR is exactly 60%, the loan would qualify for the ≤60% LVR tier. If the LVR is exactly 70%, the loan would qualify for the 60-70% LVR tier. LVR is calculated using Loan Amount, which does not include redraw or offset funds and is based off your property value from the approved property valuation at the time you originally applied for the loan. AcceleRATES rewards loan pay down and isn’t intended to vary with your property’s value. We will not generally accept revaluation requests except at our discretion and at cost to the borrower, where the property has materially changed, such as with a major renovation.

³ Automatic Rate Match. Applies to Athena's Straight Up and Power Up Home Loan products and excludes all others. A like-for-like loan means the product name (e.g., Straight Up) and LVR tier (e.g., ≤50%, 50-60%, 60-70%, or 70-80%) advertised to new customers must be the same product name and the same LVR tier that you have as an existing customer. The way we construct and name products may include a combination of the loan’s purpose (e.g., Owner, Investor), repayment type (e.g., P&I, IO), interest type (e.g., variable), borrower type, different features, or specific qualification criteria. However, none of these criteria will be designed to favour new customers over existing customers. If we ever offer new customers a lower rate on a like-for-like loan, anyone who’s on it will get the Automatic Rate Match.

⁴ Calculated using the RBA 2024 Bank Fees Report, which found that Australians paid $811 million in 2023 on home loans (RBA January 2024), divided by the number of households with a mortgage (ABS Housing: Census 2021). Your situation may be different.

#1 digital lender 2023~